It’s rare to go a full day without reading a headline in your email inbox or on a news site highlighting the rapid demise of the retail industry. Many brands that have become household names are undergoing massive business restructuring or shuttering their doors altogether. Shopping malls that once served as go-to destinations for many communities are experiencing increasing vacancies. The perception largely driven by the media is that brick and mortar retail is a sinking ship, but what is the reality? Deloitte set out on a nearly year-long study to better understand the state of retail as it stands today and the driving forces behind recent changes. And what did they find? The silver lining.

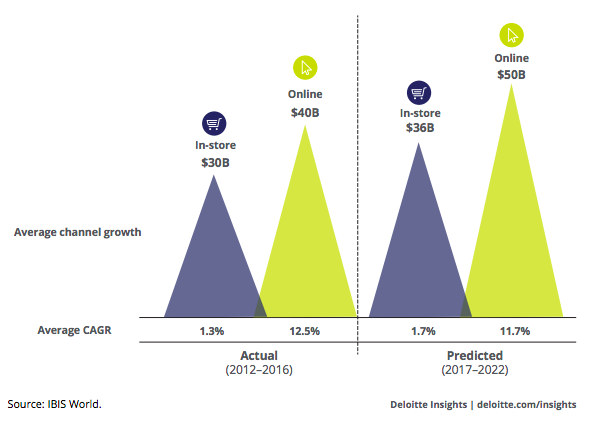

Despite the onslaught of negative press, retail is still growing and in many places, thriving. Backed by a stable and growing economy, consumer confidence is at an all time high. Experts predict that in the next five years, online sales will grow 11.7 percent annually, and in store sales by 1.7 percent.1 That’s healthy growth across the board.

Deloitte found that a big contributor to the success of brick and mortar stores actually comes down to income. Today, shoppers in lower income brackets prefer to to buy in physical stores. As the wealth gap continues to widen, more and more Americans are losing their discretionary incomes and landing in this low earning bracket. The purchases they make will likely be in person, so brick and mortar stores stand to benefit the most from this change in the distribution of wealth.

With this in mind, here are a few marketing priorities to consider:

1. Fine tune your customer acquisition strategy

Yes, you know a lot about your customers, but are you investing into the right channels that will lead them (and other audiences who look like them) to make a purchase? As mentioned previously, even details like household income (HHI) play a significant role in the way people shop. Consumers with a low HHI may compare prices online before ultimately going into a nearby store to make a purchase. Your marketing dollars should be aligned with these behaviors. For many brands, it may be time to reevaluate how consumers search, and ultimately buy. Find an agency that can help you understand the unique features of your most profitable audiences, and then identify the right mix of channels to activate them. Small optimizations on the front-end can have a big impact on long-term growth.

2. Make it easy for consumers to compare prices and find inventory at nearby stores

Eighty-one percent of consumers do online research before making a purchase.2 Whether shoppers are becoming more cost conscious or simply cost aware, the fact is they are more informed than ever before. Retailers should leverage local ads to motivate store visits. Solutions like Google’s Local Inventory Ads and Brand Showcase Ads allow shoppers to quickly locate information on the products they’re looking for as well as their availability in nearby stores. Google also has a feature that allows advertisers to adjust bids for individuals with a certain income range (from the top 10% to the lower 50%), who live within a certain geography. If you’re a multichannel retailer who sells discounted items, you may want to increase bids for searches that originate in an area in the lower 50% household income level. To measure the impact these ads are having on driving purchases in stores, check out Google’s Store Visits tool. Store Visits uses anonymous, aggregated data to measure the number of people who click or view ads and later visit a store.

3. Build superior storefront shopping experiences

The digital and physical shopping experience shouldn’t be planned in silos, rather they should be developed as a consistent end-to-end experience. Forty-two percent of in-store shoppers search for more information while in a physical store3 and savvy retailers like Sephora are combining digital elements into their physical stores to make it easy for shoppers to explore, find and purchase the products that are right for them. Discount retailers like Marshalls are making the physical shopping experience more social by encouraging store visitors to share their unique finds with their social networks using the hashtag #marshallssurprise.

4. Leverage partnerships to grow awareness and sales

Brands and retailers often market to the same consumers, so by working together, their power is magnified. With ecommerce set to experience double-digit growth over the next five years, digital co-op investments are a great way for brands to increase their exposure online and drive sales across channels. The right agency can help you identify, manage, and measure the outcomes of these opportunities.

While the Retail industry is alive and well, we are seeing a massive shift in the way multichannel retailers operate to meet the changing needs of their consumers. And let’s not count out pure-play e-tailers. Amazon is working hard to turn low income shoppers into loyal customers. Individuals who receive government assistance can qualify for a reduced $5.99 a month Prime membership, and EBT cards can now be used to pay for qualifying groceries. We expect that as brands compete more on price and free shipping becomes more universal, consumers from all income brackets will begin to make more purchases online.

As Socrates once said, “the secret of change is to focus all of your energy, not on fighting the old, but on building the new.”

Here’s to building the new.

You can access a copy of the Deloitte study, The Great Retail Bifurcation, here.

1 IBIS World

2 GE Capital

Learn more about how our retail marketing agency can help elevate your brand.